We all want our product on the retailer's shelf. But more importantly, how do you get from that shelf to the shopping cart? How do you stay relevant as a food producer for the retailer? It all starts with knowing the deepest motivations of the shopper.

The better you understand the shopper, the more effectively you can respond to their wishes and thus increase your chances on the shop shelf. It sounds so simple. But who is this shopper? What drives her/him?

"All the marketing efforts of a food producer are in vain if a potential customer does not succeed in becoming an actual brand buyer at the point of sale. If you know what shoppers need, you also know what changes are needed to improve Category Performance. The need for insight into shopper behaviour is becoming an increasing priority. If the food producer and the retailer can reach agreement on shopper needs, both can achieve better Category Performance. More shopper insight therefore helps both parties," explains Wim Schipper, Managing Partner Benelux at Shopper Intelligence.

Is a purchase planned or unplanned? Did promotion play a role? What is the category's role within the total shop? What is really important to the shopper? Price? Quality? Innovation? Promotion? And how do we perform on these factors? What major improvements are needed? For whom is the shopper buying the product? What are important listing arguments? And what does this mean for our strategy? A small selection of the questions Shopper Intelligence can answer.

'Find out what shoppers, think, want and do'

"We go much further than relying on hard scanning data," says Wim. "These mainly provide insight into what is being sold within a certain category. We supplement that with essential high-quality data. With in-store observations and questionnaires, we measure shopper behaviour. How they think, behave and make decisions and what makes 'a shopping customer' a 'shopper'. What plays a part in their decision making?"

An automated observation system measures actual shopping behaviour and conversion per shop; per aisle, per category and per brand. "The questionnaires are the same for all shoppers. This enables the results to be compared with macro categories, other retailers, channels, regions and even countries," says Mark de Jong, Managing Partner Benelux at Shopper Intelligence. "The research is very large-scale and the database is updated every year. In the Netherlands Shopper Intelligence provides insights for all categories at Albert Heijn, Jumbo and the discounters Aldi/Lidl. In Belgium we do the same for Carrefour, Colruyt, Delhaize and the discounters Aldi/Lidl." To illustrate, he gives two practical examples.

A food producer of vegetarian frozen food was confronted with de-listings from an individual retailer: more and more of its products were being removed from the assortment because, according to the retailer, the sales criteria for the category "Frozen Food" were not met. Until the food producer was able to show, with objective data from Shopper Intelligence, that it was precisely the vegetarian shoppers of this retailer who found "having enough choice" for the category "Frozen Food" to be the most important argument for coming to the shop in the first place. The buyer realised that removing even more products would mean a risk: namely, of losing the entire shopping cart of these shoppers. Many products were then reintroduced to the range.

'We measure actual shopping behaviour'

A food producer in the confectionery category was told by a major retailer that 'health' was a higher priority and that there would be less promotional space for confectionery. Based on actual shopper insights and by comparing different categories in-store, the food manufacturer was able to demonstrate the strength of its category in stimulating unplanned purchases. He was able to determine a value for that additional role, and calculate the potential net loss. With his information, he was able to prevent some of the potential sales loss.

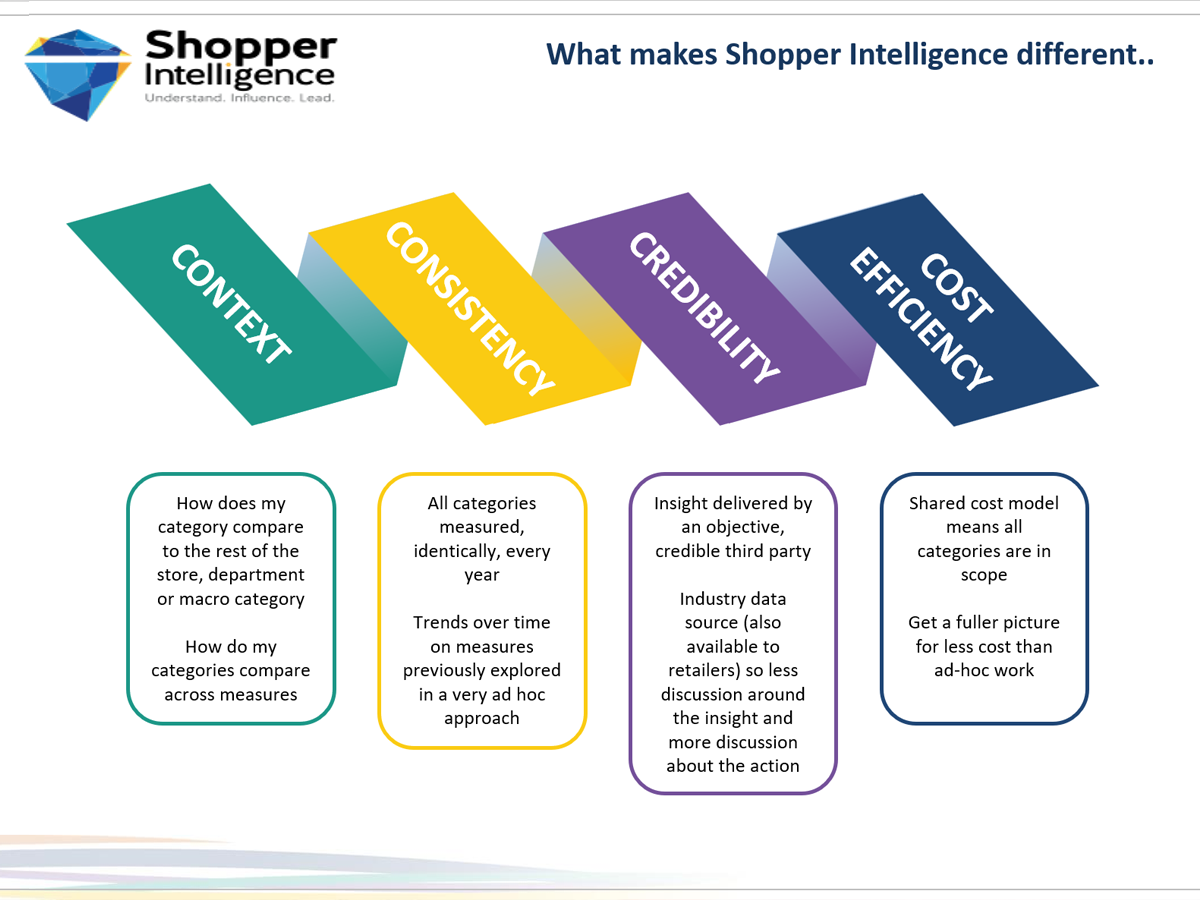

Wim: "In short, Shopper Intelligence makes comparisons that really matter to retailers. Thanks to a cost-efficient process and powerful software, our customers have the data at their fingertips all year round; data they can use to effectively implement projects, brand, category and account plans. A specialised team supports clients in identifying the 'so what' and turning insights into commercial action. Adapted to the unique profile of the various retailers, which significantly increases the chance of getting/staying on the shelf."

Photo woman in supermarket: ©Deman/Shutterstock.com

Source: Vakblad Voedingsindustrie 2021