In the second quarter of 2024, the Dutch food industry experienced a slight decline in revenue, dropping by 0.6 percent compared to the same period last year. This followed a more significant decrease of nearly 10 percent in the first quarter of the year.

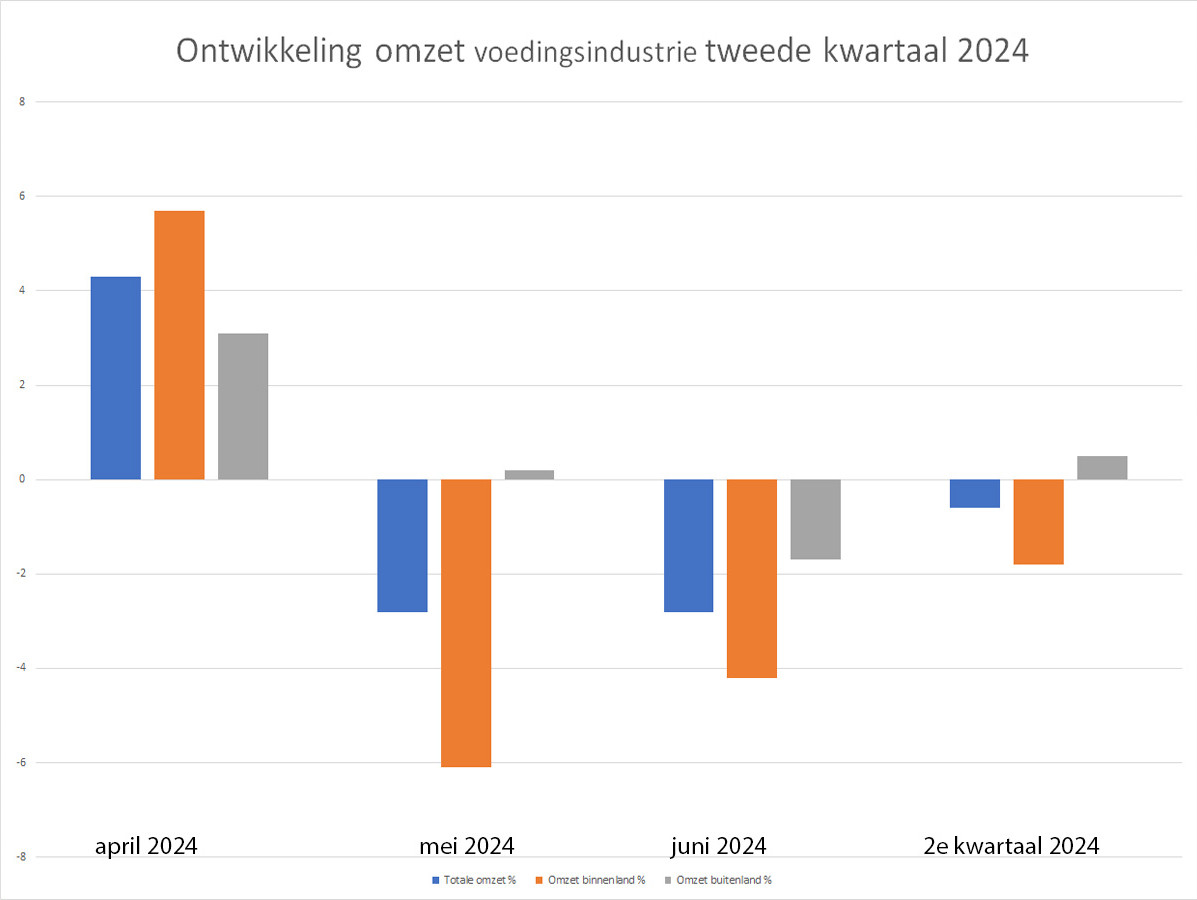

The modest decline in the second quarter was mainly due to negative developments in May and June, while April was the only month that saw a revenue increase. Expectations for the third quarter are bleak, with business owners showing little confidence in a recovery.

The revenue decline was primarily felt in the domestic market, where a decrease of 1.8 percent was recorded. In contrast, export revenue saw a slight increase of 0.5 percent. April stood out with a 5.7 percent increase in domestic revenue and a 3.1 percent rise in exports. However, the subsequent months of May and June showed a 2.8 percent decline, resulting in an overall negative balance for the second quarter. This underscores the ongoing challenges the sector faces in the domestic market.

Despite the revenue decline, prices in the food industry rose on average by 0.8 percent compared to the same period last year. However, this trend was not uniform across the board. Prices in the animal feed industry (-9.9 percent), the oils and fats industry (-8 percent), the milling industry (-6 percent), and the slaughterhouses and meat products industry (-5.4 percent) saw significant drops. Conversely, sectors such as the fruit and vegetable processing industry (+2.6 percent), the fish processing industry (+0.7 percent), and other food products industry (+18.1 percent) experienced price increases.

The sector's dynamics were further highlighted by an increase in the number of companies, with 85 new businesses bringing the total to 7,955. The bread and pastry industry saw the most significant growth in the number of companies, making it the largest sub-sector in the industry.

Despite this growth, there were also some bankruptcies. In the second quarter, seven companies went bankrupt, including three in the bread and pastry industry and two in the slaughterhouses and meat products industry. Business owners remain concerned about the future, particularly regarding revenue developments in the upcoming quarter, though there is some optimism about potential price increases.

Source: Vakblad Voedingsindustrie 2024