In the food industry, the number of entrepreneurs expecting to exist for at least another year at the beginning of November 2022 was significantly lower than in May. Just over half of the number of entrepreneurs in the food industry said in November that the high prices of energy and raw materials play a decisive role in their assessment of the continuity of their business. Output prices in the food industry increased by 22 per cent in October. This is according to an analysis of recent CBS business cycle figures by our editors.

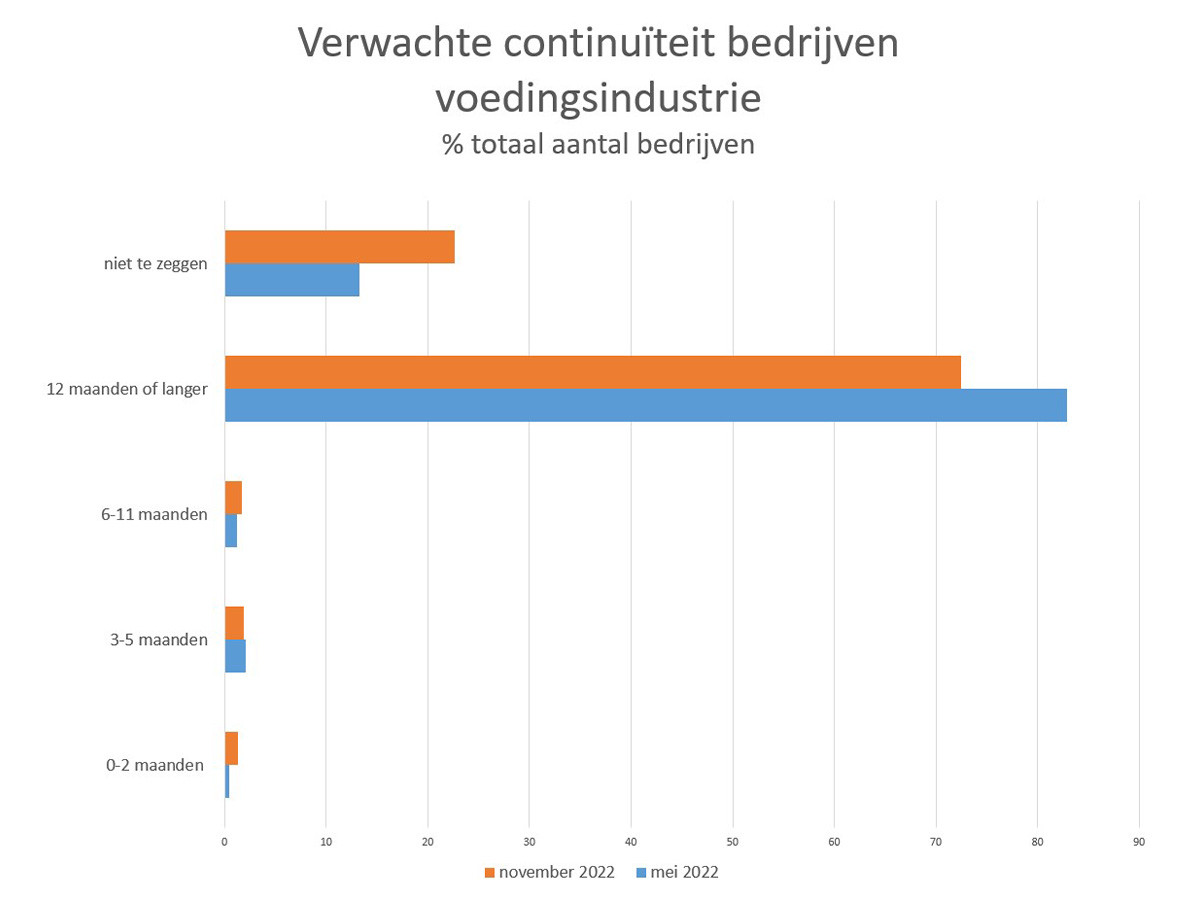

Of all companies in the food industry, 72.5 per cent of entrepreneurs in November expected to survive at least a year under current economic conditions; 1.7 per cent expected to survive six months to a year and 1.9 per cent three months to six months. 1.3 per cent of businesses expected to survive up to three months and 22.6 per cent said in November they could not say how long they would be able to maintain business continuity under current economic conditions. Notably, the percentage of companies that thought they could survive for at least another year in November fell significantly compared to May. In May, it was still 82.9 per cent.

50.8 per cent of entrepreneurs in the food industry felt in November that the high prices of energy and raw materials in particular threaten the survival of their business. Over 43 per cent of entrepreneurs felt that high prices of energy and raw materials play a role, but not a decisive one, while 6.0 per cent felt high prices play little or no role.

Food industry output prices rose 22.0 per cent in October compared to October last year. Since April this year, there has been virtually no movement in the rate of increase in output prices. The highest price increase dates from July (+23.2 per cent), the lowest from April (+21.7 per cent). On average, food industry output prices rose 20.4 per cent in the January-October period. In October, within the food industry, output prices of the flour industry (+36.7 per cent) and the slaughtering and meat products industry (+29.9 per cent) rose the most, of the bread and pasta industry (+11.7 per cent) and the dairy industry (+18.9 per cent) the least.

Source: Vakblad Voedingsindustrie 2022