For 2 out of 3 Belgian food companies, the financial warning lights have gone on in recent months, and 4 out of 10 companies are even at risk of going under when faced with a new economic blow. These are the worrying conclusions of a study on shock resistance that Fevia commissioned from Graydon.

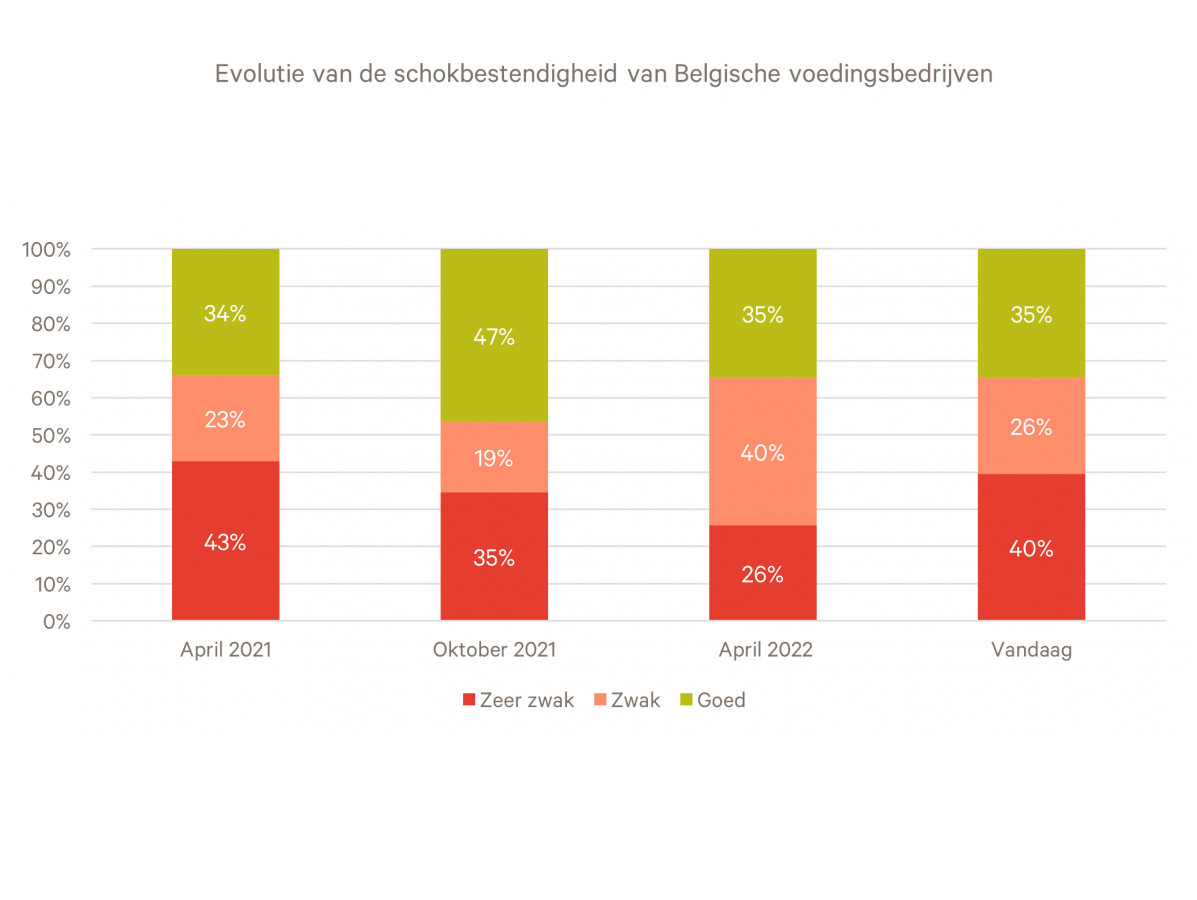

With the shock resistance score, Graydon calculates the extent to which a company can absorb one or more shocks. For the beverage and food sector, it turns out that 87% of enterprises were very healthy before the COVID crisis. Today, 66% of the Belgian food companies are insufficiently shock resistant. For 40% of the companies, the situation is extremely unfavourable.

The study clearly shows that food companies had not yet fully digested the negative consequences of the COVID crisis. In the meantime, almost all cost items have risen further to unprecedented heights. The comparison of the period from January to August 2022 with the same periods in 2021 and 2020 - in which the companies were already confronted with shortages and hefty price increases - shows that the situation is becoming untenable for many food companies.

A survey among the members of Fevia shows that barely half the food companies received a price increase from supermarkets in 2022. In most cases, this was less than half of the increased costs. Fevia members are therefore concerned about the wafer-thin margins that remain for investment and innovation. For many of them, it is even a matter of pure survival. In addition, the food companies are awaiting a wage indexation of more than 10% in January 2023. This threatens to make Belgian food companies less competitive as wage increases in neighbouring countries are much lower.

Fevia's chairman Anthony Botelberge calls on policy makers and chain partners to act now to prevent the affected companies from going under. Fevia worked out concrete proposals in recent weeks, which it shared with the government(s).

View the proposals on fevia.be (Dutch only)

Source: Fevia