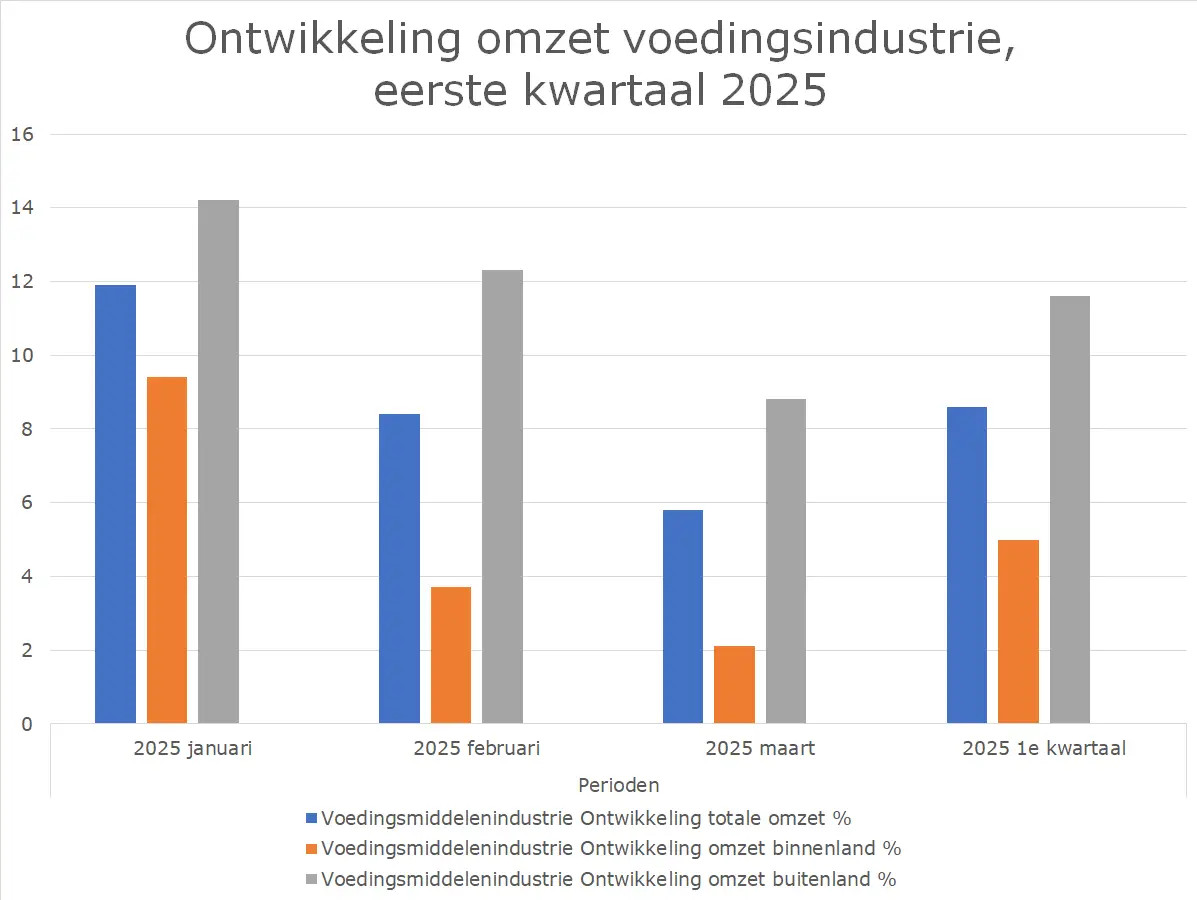

The food industry is kicking off 2025 with a noticeable recovery. After a sharp drop in revenue during the first quarter of 2024, the numbers are now back in the black. Over the first three months of this year, revenue rose by 8.6 percent. That brings the sector back to the level seen in early 2023. Foreign demand plays a key role in that rebound. At the same time, the number of businesses is shrinking, and bankruptcies have more than doubled.

The recovery is largely driven by demand beyond Dutch borders. In the first quarter, exports increased by no less than 11.6 percent. The domestic market lagged behind, showing a modest rise of just under 5 percent. January stood out in particular, with export growth peaking at 14.2 percent. Growth remained strong in February (+12.3 percent) and March (+8.8 percent), with foreign buyers continuing to outpace domestic ones.

The rise in revenue is closely tied to higher selling prices. On average, prices in the food industry went up by 5.6 percent. The dairy sector (+4.6 percent) and animal feed industry (+4.1 percent) were close to that average. Price increases were more modest in fish processing (+2.5 percent), fruit and vegetable processing (+2.8 percent), and the oils and fats sector (+0.3 percent). The biggest price drops came from the flour industry (-4.0 percent) and the meat processing sector (-0.1 percent).

Despite the revenue growth, the sector saw a significant decline in the number of active businesses during the first quarter. The total dropped from 7,915 to 7,780 – a decrease of 1.7 percent. The oils and fats industry (-7.1 percent) and the slaughterhouses and meat products sector (-4.9 percent) were hit the hardest. No single segment showed an increase in the number of businesses.

The number of bankruptcies rose sharply. Fourteen businesses in the food industry filed for bankruptcy in the first quarter of this year, compared to six during the same period last year. The biggest impact was felt in the bakery and dough products sector, where eight companies went under.

Source: Vakblad Voedingsindustrie 2025