Meat alternatives have the potential to disrupt the global meat industry to the tune of many billions of dollars. However, the key questions are which of these new products can be most disruptive, what are the resulting shifts in the value chain and who will benefit most from them?

The world's population - which was around 7.6 billion people in 2018 - is expected to increase to around 10 billion by 2050. A huge amount of food is needed to support all these people. However, according to the Food and Agriculture Organisation of the United Nations (FAO), almost half of the global harvest is needed to feed the livestock. Agricultural production for direct human consumption accounts for only 37% and represents the second largest crop block (before biofuel, industrial production and others). For example, most of the harvest is fed to animals to produce meat, which is ultimately consumed by humans.

The global agriculture and meat industry faces enormous challenges in meeting the growing global demand for meat while transforming into a more sustainable meat system.

New meat products and market players are in development

Instead of further optimising conventional meat production, various companies are focusing on devising new products to replace conventionally produced meat. These products range from vegetable meat alternatives and insect-based meat substitutes to cultured meat. As many companies with slightly different product ranges have emerged, the list of new products and brands is long and continues to grow.

The disruption of the meat industry offers enormous opportunities

The disruption of the meat industry offers enormous opportunitiesAt this stage, it is difficult to say how quickly the disruption will occur. However, one can already see how wholesalers, retailers and consumer goods companies are trying to find a lucrative starting position by purchasing exclusive distribution rights or by acquiring new businesses. That is why A.T. Kearney has qualitatively predicted the development of the meat market until 2040 on the basis of reliable economic data and on the basis of their research and discussions with numerous experts in the field.

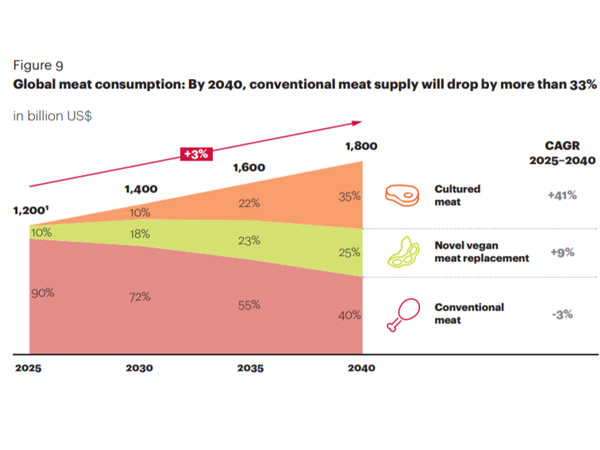

Based on the A.T. Kearney analysis, approximately one third of the world's meat supply will be provided by these new technologies within the next 10 years. Remarkably, the demand for conventional meat is decreasing by 3 percent, despite a global increase in meat consumption of 3 percent per year. New vegan meat substitutes will show strong growth in the transition phase (until 2030), while farmed meat - with an annual growth rate of 41 percent per year - will outgrow new vegan meat substitutes between 2025 and 2040 as a result of technological developments and consumer preference.

A characteristic of the development of the global meat market will be that an evolution of the global meat consumption (+3 percent per year) is accompanied by a disruption in the meat segments - the market share of conventional meat goes massively downhill in favour of cultivated meat and meat substitutes. It is also interesting to note that new biotechnological methods will not only disrupt the meat industry, but that the entire food industry such as milk, protein, gelatine and fish can be created with similar technology.

All in all, farmed meat and new meat substitutes will disrupt the conventional meat industry with all its suppliers, which accounts for 1,000 billion dollars.

This raises the question: How can we "integrate" biotechnologically engineered food products into our lives so that we feel comfortable with them, just like baking bread or brewing beer?

Click here for the full report: 'How Will Cultured Meat and Meat Alternatives Disrupt the Agricultural and Food Industry?'

Source: © A.T. Kearney